ESG and Corporate Performance

April 15, 2025

Attention to ESG (Environmental, Social, Governance) criteria is no longer optional—it has become a strategic imperative for modern businesses. Climate change and growing public awareness are pushing organizations to be more transparent about their environmental and social performance.

At the same time, investors and talent are actively seeking companies that embed sustainability into their business models and core values. In this evolving landscape, adopting well-defined ESG policies translates into tangible benefits—from enhanced reputation and talent attraction to proactive risk management and improved operational efficiency.

ESG numbers: steady accelerated growth

The growing attention to ESG is confirmed by data from the “Global Sustainable Investment Review” 2023 by GSIA:

- In 2022, sustainable investments worldwide reached $30.3 trillion.

- In markets such as Europe, Canada, Japan, Australia, and New Zealand, there was a 20% growth between 2020 and 2022, reaching $21.9 trillion.

- In Europe alone, sustainable investments increased from $12 trillion to $14 trillion in the same period.

These figures highlight how ESG is becoming central in global financial strategies, a priority for CFOs and Financial Directors.

Digital Transformation and Sustainability: A Winning Combination

Digital transformation is a critical accelerator for embedding sustainability into a company’s DNA. Digital technologies not only enable monitoring and optimization of ESG parameters but also reveal valuable correlations between sustainable practices and concrete business outcomes.

The ability to analyze complex data in real time becomes essential for measuring and evaluating the impact of sustainability-oriented projects and actions. But tracking the value generated by ESG initiatives—and demonstrating their relevance—requires clear objectives and continuous measurement of progress. This goes beyond traditional reporting tools, which lack the automation and intelligence offered by AI-powered solutions.

In this context, the Finance team needs to quickly obtain insights useful for creating strategic value by selecting the most suitable solution for ESG planning and reporting.

EPM: The Integrated Solution for Managing ESG Performance

Enterprise Performance Management (EPM) solutions offer a comprehensive approach to integrate financial and non-financial data, ensuring transparency toward stakeholders and regulatory authorities. But EPM goes beyond simple reporting, allowing the planning and management of present and future ESG strategies.

An EPM system allows analysis, understanding, and reporting on company activities. It involves planning, budgeting, forecasting, and performance reporting processes, as well as consolidation and financial closing. Although primarily used by the Finance function, EPM also supports other corporate areas such as HR, Sales, Marketing, and IT in operational planning and reporting activities.

Oracle Fusion Cloud EPM: deep dive into the leader in Gartner’s 2024 Magic Quadrant for financial planning software

Oracle Fusion Cloud Enterprise Performance Management (EPM) provides an integrated solution for financial planning and ESG reporting, offering a solid platform for analysis and insights. It enables managers to deeply understand ongoing trends and their alignment with strategic plans, increasing forecasting accuracy thanks to AI integrated for advanced predictive analysis.

The AI Agents embedded in the solution become strategic CFO allies, automating analysis and surfacing insights to translate into actions, enabling faster decision-making. More accurate cash flow forecasts for smart liquidity investment, as well as operational modeling for detailed business strategies, are just some of the concrete benefits Oracle EPM offers to management teams.

Planning logics that align with ESG goals, thanks to the wide range of functionalities offered by Oracle EPM: from human resources management to investments in renewable energy, to reducing CO2 emissions and related financial implications.

With Oracle Cloud EPM, it is possible to:

- Plan long-term sustainability goals: model objectives and monitor progress between finance and operations, adapting plans as needed.

- Generate reliable reports: efficiently collect, standardize, and aggregate ESG data.

- Set ESG goals and develop collaborative, predictive strategic plans.

- Consolidate and aggregate KPIs at the company level.

- Analyze results to obtain insights on ESG metrics and their business impact.

- Generate internal and external reports for all stakeholders.

Would you like to discover how Oracle Fusion Cloud EPM can accelerate your sustainability efforts and improve your company’s performance?

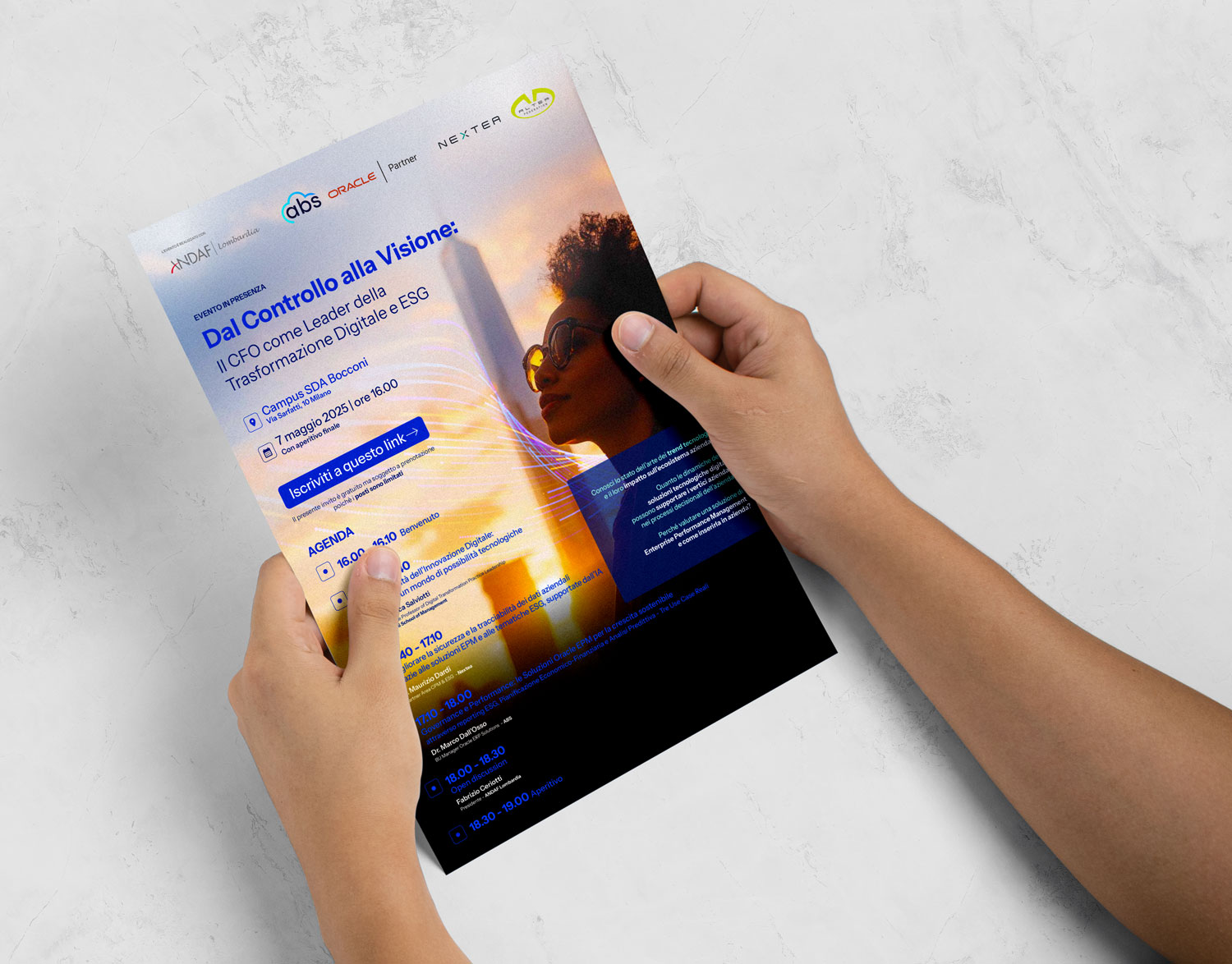

With scientific contribution from SDA Bocconi and in collaboration with ANDAF, ABS and Nextea present the systemic approach to Enterprise Performance Management in an event dedicated to CFOs, offering a unified view of financial and operational metrics, extracting insights, guiding strategic plans and execution, helping management make informed decisions.

“From Control to Vision” will be held on May 7, 2025, from 4:00 PM at the SDA Bocconi Campus in Milan (Via Sarfatti 10), with the participation of Fabrizio Ceriotti, President of ANDAF Lombardia, and Prof. Gianluca Salviotti, PhD – Associate Professor of Digital Transformation Practice Leadership at SDA Bocconi, along with real stories of companies that have already adopted advanced ESG reporting, financial planning, and predictive analysis solutions.

Don’t miss the chance to turn sustainability into a real competitive advantage for your organization!

Registration is required to attend the event.

Follow us on our social profiles.